By [Author Name] | Last Updated: January 2025 Great design solves problems, but bad legal structure creates them. I’ve seen incredibly talented designers lose months of income because they didn’t have a kill fee clause, or worse, face fines because they ignored a government filing they didn’t even know existed. In 2025, the game has changed. It’s no longer just about getting a business license and finding clients. With the rollout of the Corporate Transparency Act and strict new AI copyright rulings, ignoring the legal side of your business can cost you up to $500 per day in civil penalties. You might be thinking, “I just want to draw logos, not play lawyer.” I get it. But protecting your pixels is protecting your livelihood. According to Upwork’s “Freelance Forward 2024” report, freelancers contributed a staggering $1.5 trillion to the US economy last year. The government is paying attention, and you need to be compliant. This guide isn’t just theory. It is a battle-tested roadmap from entity formation to AI protection, specifically designed for the modern freelance creative. When you start, you are automatically a Sole Proprietor by default. While this is the easiest route—you just start working—it is also the most dangerous. In my experience working with creatives, the “Sole Prop” trap is real. If a client sues you because your web design “caused them to lose revenue,” they can come after your personal car, your savings, and your house. A Limited Liability Company (LLC) creates a legal wall between your business assets and your personal life. If the business gets sued, your personal assets are generally safe. Plus, it adds a layer of professionalism that high-ticket clients expect. This is the most critical update in this entire guide. Most old blog posts won’t tell you this. As of 2024/2025, most LLCs must file a Beneficial Ownership Information (BOI) report with FinCEN. According to the FinCEN Guidance on Small Entity Compliance (2024), ignorance is not a defense. Failing to file this report can result in civil penalties of up to $500 per day. Action Item: If you form an LLC in 2025, you have 90 days to file. If you formed one before 2024, ensure your report is filed immediately. For years, getting stiffed by clients was just “part of the business.” That is changing rapidly. State governments are finally cracking down on non-paying clients, but you have to know how to trigger these protections. If you are based in—or working for clients in—New York, Illinois, or California, you have new leverage. A 2024 report from the Freelancers Union noted that 71% of freelancers experienced late or non-payment in 2024. These laws are the antidote. The “Freelance Isn’t Free” legislation mandates written contracts and 30-day payment terms (unless otherwise specified). However, the dollar thresholds vary: “New York’s expanded ‘Freelance Isn’t Free Act’ isn’t just a suggestion; it allows freelancers to recover double damages if a client refuses to provide a written contract.”

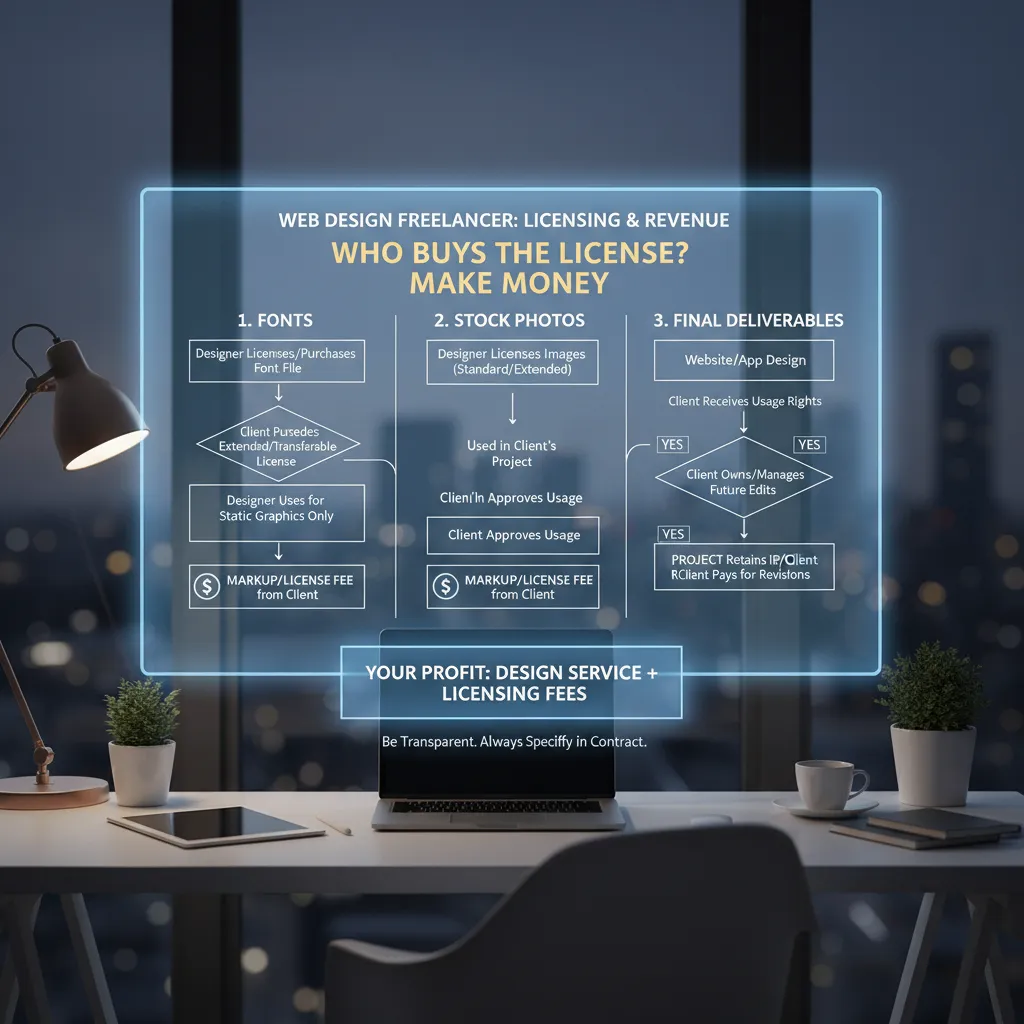

Case Study Context: I recall a freelance illustrator in NYC who was owed $5,000. Because the client refused to provide a written contract, under the new expansion, the freelancer successfully sued for $10,000 (double damages) plus attorney fees. Contracts are no longer optional. A contract isn’t just about getting paid; it’s a relationship manual. “Scope creep”—where a client asks for “just one more quick change” 50 times—is the number one profitability killer for designers. Your contract is the only thing stopping it. This is where new designers lose money. If your contract says “Work for Hire,” the client owns everything—the final PDF, the messy Illustrator source files, the sketches, everything. You legally cannot use that work again. Instead, structure your agreement as a “License to Use.” You retain ownership of the source files and IP, granting the client rights to use the final output. If they want the source files later? That’s an extra fee. Projects get cancelled. It happens. Without a kill fee clause, you might do 90% of the work and get $0 because the project didn’t “launch.” A standard kill fee ensures that if the client cancels, you are paid for all work completed up to that date, plus a percentage (usually 20-50%) of the remaining balance to cover your booked schedule. With the rise of tools like Midjourney, clients are nervous about copyright (more on this in Step 7). You need a clause that specifically addresses AI. Are you using it? Are you indemnifying the client if the AI accidentally copies a protected work? Clarity here prevents lawsuits later. One question I see constantly in forums is: “Who owns the design?” The answer lies in the US Copyright Office regulations. By default, the creator (you) owns the copyright the moment the work is fixed in a tangible medium. However, most clients assume they own it because they paid for it. This misalignment is dangerous. You must explicitly transfer rights in writing only after full payment is received. If you design a logo, your client will likely want to trademark it. Be careful here. Never guarantee a logo is “trademarkable.” That is a lawyer’s job. Your contract should state that you have created an original design, but the client is responsible for their own trademark searches and registration costs. This is a classic mistake. You buy a font license for your computer. You use it in a client’s logo. The client puts that logo on 10,000 t-shirts. The font foundry sues the client because they didn’t buy a commercial license. The Fix: Always outline in your contract that the client is responsible for purchasing their own licenses for any fonts or stock assets used in the final deliverables. Let’s talk about the uncomfortable part: The IRS. In 2025, the Self-Employment tax rate remains a shock to many. (12.4% Social Security + 2.9% Medicare) on the first $176,100 of income. According to the IRS.gov “Self-Employment Tax Rates 2025”, this 15.3% is on top of your regular income tax. If you don’t set this money aside, tax season will destroy your cash flow. Freelancers cannot wait until April 15th to pay. The US has a “pay as you go” tax system. You must file Form 1040-ES quarterly. For 2025, the deadlines are typically April 15, June 15, September 15, and January 15 (of the following year). The good news? You can lower that taxable income. Legitimate deductions for designers include: Do you really need insurance if you work from your couch? Yes. A staggering 77% of small businesses in the US are underinsured against liability claims as of 2025, according to a report by Hiscox (Underinsurance Report 2025). Imagine this scenario: You design a brochure for a client. You accidentally type the phone number wrong. The client prints 10,000 copies before noticing. They sue you for the cost of reprinting ($5,000+). General liability won’t cover this, but Errors & Omissions (E&O) insurance will. This is less critical for remote workers but essential if clients visit your home office. It covers physical accidents (like a client tripping over your power cord). The legal landscape regarding AI is volatile. The case of Jason Allen v. US Copyright Office set a massive precedent that every designer must understand in 2025. Jason Allen used Midjourney to create an award-winning image, “Théâtre D’opéra Spatial.” He attempted to copyright it. The US Copyright Office rejected the registration (affirmed in 2024), stating that AI-generated art lacks “human authorship.” “If a work is created by AI, it is not protectable by copyright… Human authorship is a bedrock of copyrightability.”

If you use AI to generate a logo for a client, you cannot legally transfer ownership of that logo to the client because you don’t own it in the first place. It is effectively public domain. If you sell it as “exclusive work,” you could be sued for fraud or breach of contract. The Solution: Be transparent. Use AI for brainstorming or mood boards, but ensure the final deliverable is created by human hand (vectors, hand-drawing) if the client requires copyright ownership. If you do use AI elements, disclose it in the contract explicitly. It depends on your city and state. While you can technically start working, many cities require a general business license even for home-based sole proprietors. Operating without one can lead to fines. Absolutely. “Commingling” funds (mixing personal and business money) pierces the corporate veil. If you are an LLC but pay for groceries with your business card, a court can declare your LLC invalid and hold you personally liable. As mentioned in Step 1, the penalties are severe ($500/day). The Corporate Transparency Act is not something to gamble with. File it through the FinCEN website immediately. Starting a freelance design business is one of the most rewarding career moves you can make. It offers freedom, creativity, and uncapped earning potential. But as we’ve seen, the “boring” legal stuff is actually the foundation that keeps that freedom safe. The difference between a stressed-out freelancer and a successful studio owner often comes down to structure. The successful owner has an LLC to protect their assets, a contract that guarantees payment, and insurance that covers mistakes. Your Immediate Checklist: Don’t let the legalese scare you. Tackle these steps one by one, and you’ll build a business that is designed as beautifully as your portfolio.9 Essential Legal Steps for Starting Design Freelancing (2025 Compliance Guide)

Step 1: Choose Your Business Structure (The LLC Advantage)

Why 80% of High-Earning Designers Choose an LLC

🚨 MANDATORY 2025 UPDATE: The Corporate Transparency Act

Step 2: Master the “Freelance Isn’t Free” Acts

Know Your Thresholds

Step 3: Bulletproof Design Contracts (Beyond the Basics)

“Work for Hire” vs. “License to Use”

The “Kill Fee” Clause

New for 2025: The AI Disclosure Clause

Step 4: Intellectual Property & Copyright Strategy

Trademarking Client Logos

Font Licensing: The Hidden Landmine

Step 5: Tax Compliance for Creatives

2025 Self-Employment Tax Rate

Quarterly Estimated Taxes (1040-ES)

Deducting Expenses Legally

Step 6: Insurance: Protecting Your Pixels

Professional Liability (Errors & Omissions)

General Liability

Step 7: Managing AI Tools Legally

The Trap for Designers

FAQ: Common Legal Questions for Freelancers

“Can I freelance without a business license?”

“Do I need a separate bank account?”

“What happens if I forget the BOI report?”

Conclusion